August 2024 brought notable shifts in the cryptocurrency market, impacting both prices and investor sentiment. Amid significant economic and political developments, Bitcoin and Ethereum continued their upward trends, while broader market volatility created a complex environment for crypto investors. Major events, from policy changes to market indicators, shaped the landscape and set the stage for further uncertainty as the year progresses.

Crypto cap

In August 2024, the total cryptocurrency market cap dropped by $250 billion, representing an 11.0% decline. Breaking down the crypto market into segments—Bitcoin, Ether, top 3-10 coins, and other cryptocurrencies—Bitcoin saw the most growth, with a smaller decrease of 8.7%. Consequently, Bitcoin's market dominance increased by 2.5%, reaching 57.4%. When larger market cap cryptocurrencies, like Bitcoin, outperform smaller cap cryptos, this is often viewed as a risk-off move, particularly when the dominance of stablecoins also rises.

Bitcoin and Ethereum, price and annual ROI trend

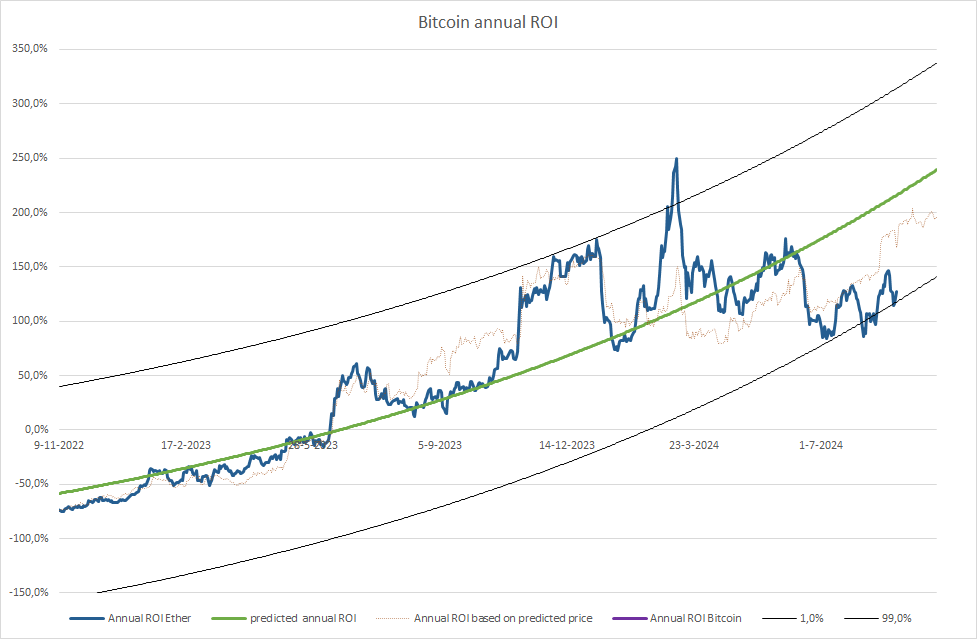

Since November 9, 2022, both Bitcoin and Ether have been in upward price trends, but it's important to recognize that these trends won't last forever. If the Bitcoin price trend continues, there’s a 50% chance it will be around $79.7k by September 30, 2024, and a 98% probability that it will range between $64.7k and $94.8k. Similarly, Ether's price has a 50% chance of reaching around $3.7k and a 98% chance of falling between $2.8k and $4.6k by the same date. However, if either cryptocurrency gains or loses momentum, prices could move outside these ranges.

One way to assess price momentum is by looking at the annual return on investment (ROI), which measures the ROI if you had bought Bitcoin or Ether exactly one year ago. Just like prices, Bitcoin's and Ether's annual ROI have been on an upward trend since November 9, 2022. If these trends continue, there is a 50% chance that Bitcoin's ROI will place its price around $91.5k, with a 98% probability that it will fall between $65.0k and $118.0k by September 30, 2024. For Ether, there is a 50% chance it will be around $4.1k and a 98% chance of ranging between $2.8k and $5.4k. However, just like prices, ROI trends are also subject to change if momentum shifts.

Here are all the key figures mentioned for Bitcoin and Ether:

Bitcoin by September 30, 2024:

Price Trends:

50% probability: $79.7k

98% probability range: $64.7k to $94.8k

Annual ROI Trends:

50% probability: $91.5k

98% probability range: $65.0k to $118.0k

Ether (Ethereum) by September 30, 2024:

Price Trends:

50% probability: $3.7k

98% probability range: $2.8k to $4.6k

Annual ROI Trends:

50% probability: $4.1k

98% probability range: $2.8k to $5.4k

Crypto Market News

August 2024 brought significant developments in the crypto world. From economic indicators triggering market volatility to major policy shifts and legal challenges, the month was packed with events that shaped the cryptocurrency landscape. Key highlights include the activation of the Sahm Rule, plummeting Ethereum gas prices, Trump's surprising embrace of Bitcoin, signals of interest rate cuts, and the arrest of Telegram's CEO.

The Sahm Rule has been activated

As of August 2, 2024, the Sahm Rule has been activated following a disappointing July 2024 jobs report. The Sahm Rule is a recession indicator that signals the onset of a recession when the three-month moving average of the national unemployment rate rises by at least 0.50 percentage points relative to its lowest level in the previous 12 months. This rule, introduced by economist Claudia Sahm in 2019, has proven historically reliable, indicating that a recession is likely underway when the unemployment rate increases significantly. The news, released on August 2, 2024, impacted the crypto market, with Bitcoin and other major cryptocurrencies experiencing a sharp sell-off as investors moved towards safer assets amid growing economic uncertainty.

Ethereum gas prices plummet to five-year low

Ethereum's median gas price has fallen to a five-year low of 1.9 gwei, with low-priority transactions costing around 1 gwei or less. This represents a 98% drop from the 83.1 gwei high in March 2024. The decrease is attributed to increased activity on layer-2 networks following Ethereum's Dencun upgrade, which aimed to reduce transaction costs for these networks.

Trump proposes strategic Bitcoin stockpile at Nashville conference

Former President Donald Trump and Robert F. Kennedy Jr. made appearances at the Bitcoin 2024 conference in Nashville, Tennessee, marking a significant shift in their stance on cryptocurrency. Trump, who once criticized bitcoin as "based on thin air," now embraced the technology and promised to make the U.S. a "bitcoin superpower" if re-elected. He vowed to establish a "strategic Bitcoin stockpile" and end what he called the Biden administration's "anti-crypto crusade." Trump's speech included promises to create a "bitcoin and crypto presidential advisory council" and to halt efforts to develop a central bank digital currency. He also pledged to fire SEC chairman Gary Gensler, known for his crypto crackdowns. In a related development, the U.S. government, currently the largest geopolitical holder of Bitcoin with 203,000 BTC (valued at approximately $12 billion), moved 10,000 Bitcoin to a new wallet on August 14, 2024. This transfer, worth nearly $594 million, involved funds seized during the Silk Road raid. The move follows a previous transfer of 29,800 BTC in July, highlighting the government's significant cryptocurrency holdings.

Interest rate cuts ahead

Federal Reserve Chair Jerome Powell signalled a likely interest rate cut in September during his speech at the Jackson Hole economic symposium. Powell stated that "the time has come for policy to adjust," citing easing inflation and growing downside risks to employment. He expressed increased confidence that inflation is on a sustainable path back to the Fed's 2% target. While Powell didn't specify the size of the potential rate cut, markets are pricing in a 25 basis point reduction, with some analysts suggesting a 50 basis point cut is possible. Bitcoin and traditional markets responded positively to Powell's remarks, with Bitcoin rising above $61,900 shortly after the speech.

Telegram CEO Pavel Durov arrested in France

Pavel Durov, the CEO of messaging app Telegram, was arrested in Paris on August 26, 2024, facing preliminary charges related to alleged criminal activities on his platform. French authorities accuse Telegram of facilitating drug trafficking, fraud, and the distribution of child sexual abuse material. Durov, who holds multiple citizenships, was released on August 30 but barred from leaving France pending further investigation. This arrest has implications for the crypto world, given Durov's involvement with the TON (Telegram Open Network) blockchain project. Although Telegram abandoned TON in 2020 due to regulatory pressure, the project continues independently. Durov's legal troubles could potentially impact future crypto-related initiatives and Telegram's stance on digital assets. The case has sparked debate about platform liability and freedom of speech, with some viewing it as politically motivated. It also raises questions about the balance between privacy and law enforcement in encrypted messaging apps, a concern that extends to cryptocurrency transactions.

Summary

August 2024 was a turbulent month for the cryptocurrency market, marked by significant shifts in market dynamics and external events influencing price trends. While Bitcoin and Ether have remained on upward trajectories since late 2022, the future remains uncertain, with potential for both gains and corrections. Broader economic indicators, such as the activation of the Sahm Rule and anticipated interest rate cuts, combined with geopolitical developments like Trump's pro-Bitcoin stance and Telegram CEO Pavel Durov's arrest, all contribute to an increasingly complex landscape for cryptocurrency investors. Staying informed and vigilant in navigating these changes will be crucial in the months ahead.

Share this post