In the ever-evolving cryptocurrency landscape, Bitcoin has been in a consolidation phase since March 2024, forming a bullish flag pattern that signals potential upward momentum. Despite this period of consolidation, July 2024 witnessed a notable increase in the total cryptocurrency market capitalization, driven primarily by significant growth in the top-tier cryptocurrencies excluding stablecoins. Both Bitcoin and Ether continue their upward trends, which began in November 2022, with market projections indicating potential for continued growth. Concurrently, the crypto market is experiencing significant advancements, including the integration of stablecoins on Bitcoin's Lightning Network, the introduction of a Bitcoin Strategic Reserve Bill in the U.S. Senate, and the approval of spot Ethereum ETFs by the SEC, all underscoring the increasing institutional interest and regulatory progress in the sector.

Crypto cap

In July 2024, the total cryptocurrency market capitalization increased by $23 billion, representing a 1.0% growth. Breaking down the market cap into categories such as Bitcoin, Ether, top 3-10 (excluding USDC and USDT), and other cryptocurrencies reveals that the majority of this growth came from the top 3-10 cryptos, excluding USDC and USDT, which saw an 8.3% increase.

As a result, Bitcoin's market cap dominance rose by 2.1%, reaching 56.0%, while the market cap dominance of the top 3-10 cryptos, excluding USDC and USDT, increased by 7.2%, from 10.1% to 10.8%. This trend suggests a risk-off move, particularly when the dominance of stablecoins also rises, as larger market cap cryptos outperform smaller ones.

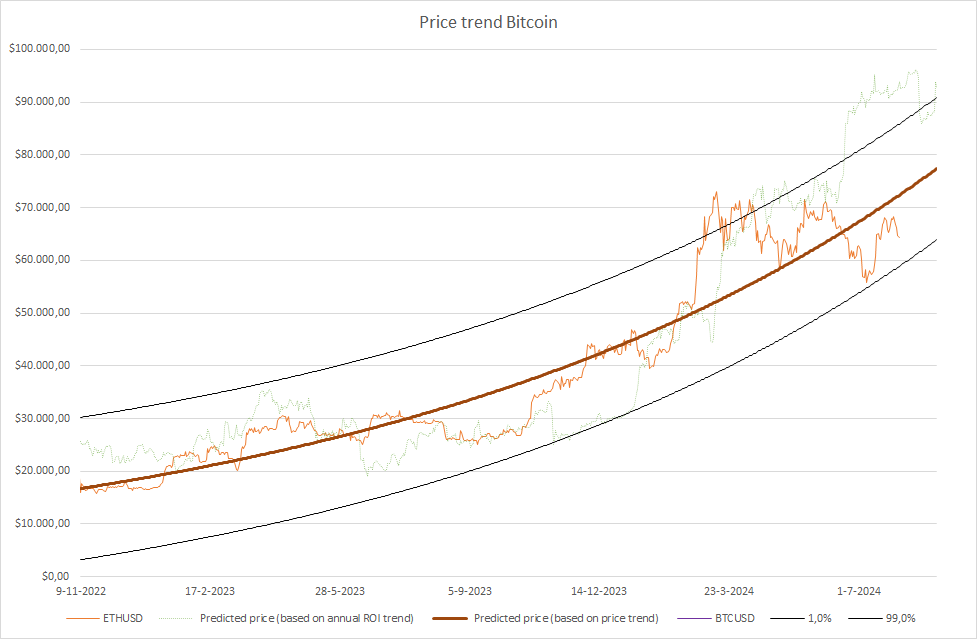

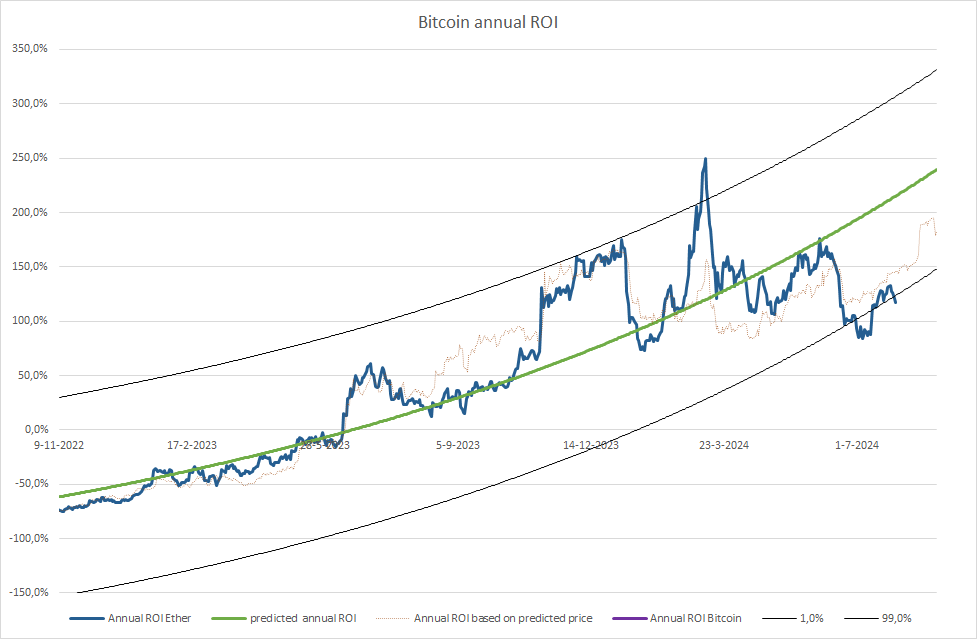

Bitcoin, price and annual ROI trend

Since November 9, 2022, Bitcoin has been in an upward price trend. However, it's important to remember that price trends are not permanent. If the current trend continues, there's a 50% probability that Bitcoin's price will be either above or below $77.4k by August 30, 2024, and a 98% probability that it will be between $63.9k and $90.9k. Should Bitcoin's price gain or lose momentum, it could exceed or fall below these figures.

Price momentum can be measured by the annual return on investment (annual ROI), which considers the ROI if Bitcoin was purchased exactly one year ago. The annual ROI, like the price, has also been in an upward trend since November 9, 2022. If this trend persists, there's a 50% probability that the annual ROI will place Bitcoin's price above or below $92.7k by August 30, 2024, and a 98% probability that the price will be between $67.7k and $117.7k. However, if Bitcoin gains or loses momentum, these figures could change.

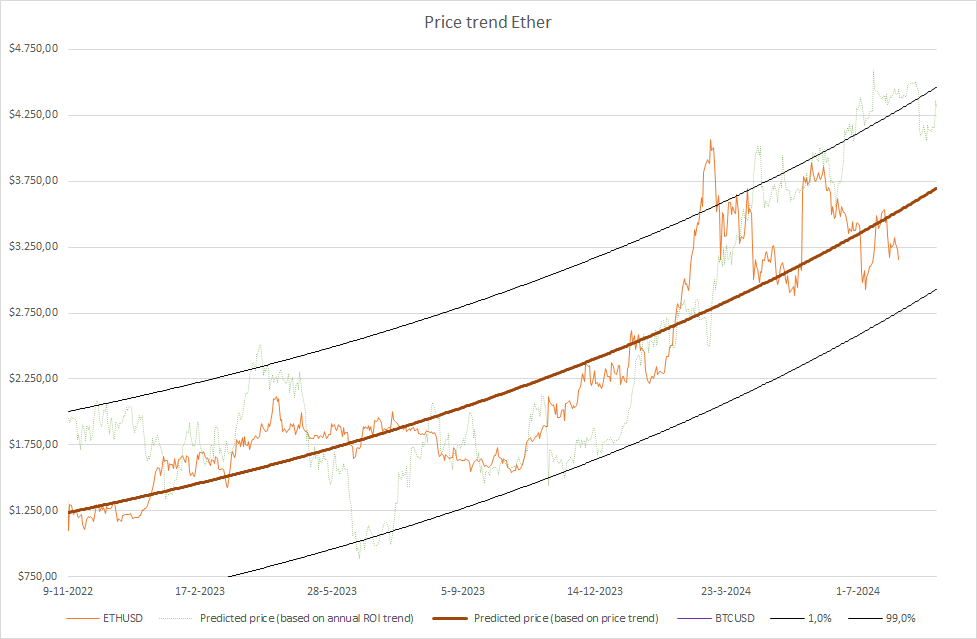

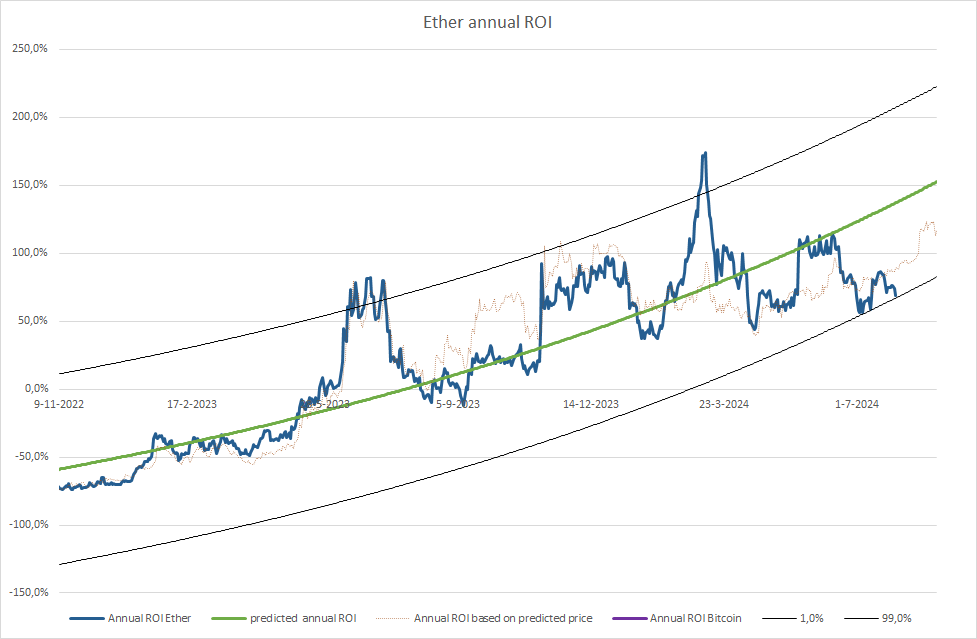

Ethereum, price and ROI trend

Since November 9, 2022, Ether has been in an upward price trend. However, it is important to understand that price trends won't last forever. If the current trend continues, there is a 50% probability that Ether's price will be above or below $3.7k by August 30, 2024, and a 98% probability that it will be between $2.9k and $4.5k. If Ether gains or loses momentum, it could exceed or fall below these figures.

Price momentum can be measured by the annual return on investment (annual ROI), which considers the ROI if Ether was purchased exactly one year ago. The annual ROI, like the price, has been in an upward trend since November 9, 2022. If this trend persists, there is a 50% probability that the annual ROI will place Ether's price above or below $4.3k by August 30, 2024, and a 98% probability that the price will be between $3.1k and $5.5k. However, if Ether gains or loses momentum, these figures could change.

Crypto Market News

Recent developments in the Bitcoin and cryptocurrency space have brought several significant advancements, regulatory changes, and legal clarifications:

Technological Advancements

Stablecoins on Bitcoin's Lightning Network: Stablecoins are set to be integrated into Bitcoin's Lightning Network, combining the network's speed and low transaction fees with the stability of pegged currencies. This integration aims to enhance the versatility of payments on the Lightning Network, potentially broadening its adoption.

Zero-Knowledge Proofs on Bitcoin: For the first time in history, a zero-knowledge proof has been verified on the Bitcoin blockchain. This cryptographic technique allows for the verification of information without revealing the underlying data, which could significantly enhance privacy and scalability on the Bitcoin network.

Regulatory and Market Developments

Bitcoin Strategic Reserve Bill: U.S. Senator Cynthia Lummis has introduced a Bitcoin Strategic Reserve Bill in the Senate. This legislation signals growing federal interest in Bitcoin and could pave the way for Bitcoin to play a role in national monetary policy.

Spot Ethereum ETFs: The SEC has approved and spot Ethereum ETFs have begun trading, marking a significant milestone for the cryptocurrency market. This development provides new avenues for institutional and retail investors to gain exposure to Ethereum through traditional financial instruments.

Circle's European License: Circle, a prominent stablecoin issuer, has obtained a MICA-compliant EMI license for operations in Europe. This regulatory compliance positions Circle to expand its services in the European market, potentially increasing the adoption of stablecoins in the region.

Legal and Judicial Developments

Craig Wright's Claims Debunked: Craig Wright, who has long claimed to be Satoshi Nakamoto, the creator of Bitcoin, has been definitively ruled out as Satoshi by the UK High Court. The court found that Wright had fabricated documents and engaged in deceitful practices to support his claims. As a result, Wright is now prohibited from asserting that he is Satoshi and faces potential criminal charges for perjury and document forgery.

Silk Road Bitcoin Movement: Significant amounts of Bitcoin associated with the infamous Silk Road marketplace have been moved recently. This movement coincides with former President Trump's promise regarding Bitcoin, sparking speculation within the cryptocurrency community.

Central Bank Digital Currencies (CBDCs)

Digital Euro Discussions: European authorities are discussing the introduction of a digital euro, considering both offline and online implementations. This move reflects the growing interest in CBDCs and their potential impact on the financial landscape.

Summary

In July 2024, the cryptocurrency market saw significant growth, particularly among the top 3-10 cryptocurrencies excluding stablecoins, leading to increased market dominance for Bitcoin. Both Bitcoin and Ether have been in upward trends since November 2022, with price and ROI projections indicating continued growth if trends persist. Major developments include the integration of stablecoins on Bitcoin's Lightning Network, a new Bitcoin Strategic Reserve Bill in the U.S. Senate, and the approval of spot Ethereum ETFs by the SEC, signaling increased institutional interest and regulatory progress in the crypto market.